The Relationship Between Time Value of Money & Interest Rates

The time value of money (TVM) is a financial concept that recognizes the idea that a sum of money today is worth more than the same amount in the future. This is based on the premise that money can earn interest or have investment potential over time.

What is TVM?

The time value of money is a fundamental principle in finance and is used in various financial calculations and decision-making processes. There are two main components of the time value of money:

Present Value (PV): Present value is the current worth of a future sum of money, discounted at a specific interest rate. It represents the amount of money you would need to invest today to have a certain amount in the future.

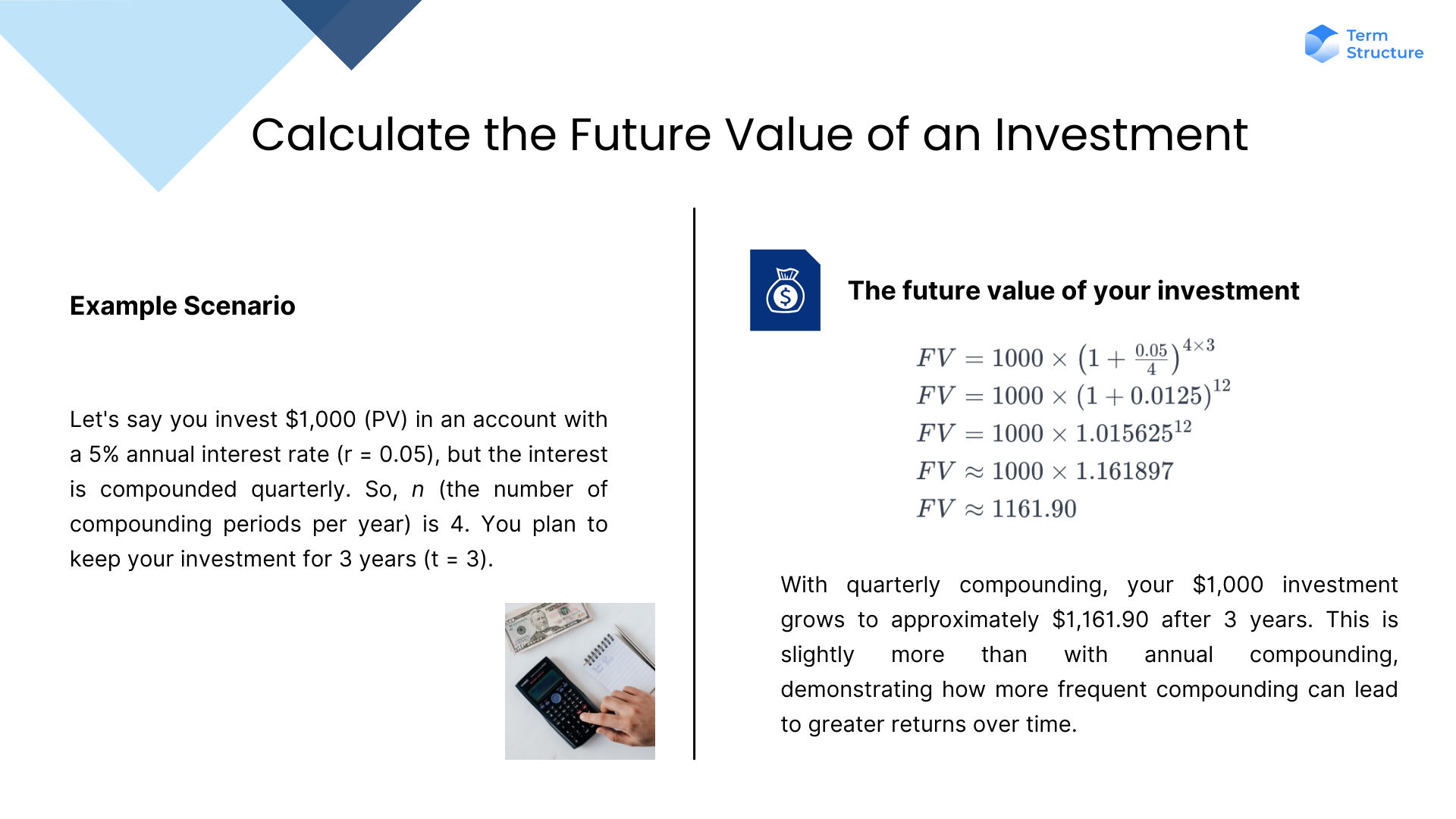

Future Value (FV): Future value is the value of a sum of money at a specific point in the future, assuming a certain interest rate. It represents the amount of money that an investment will grow to over time.

Where:

- FV = Future Value

- PV = Present Value

- r = Annual Interest Rate

- n = Number of times that interest is compounded per year

- t = Number of years the money is invested or borrowed for

If the interest is compounded annually, n=1, the formula simplifies to:

These formulas illustrate the concept that the value of money changes over time due to the opportunity to earn interest or return on investments. An interest rate is the cost of borrowing money or the return on investment expressed as a percentage of the principal amount. In other words, it is the compensation paid by borrowers to lenders for the use of their money or the reward earned by investors for providing funds.

Applications of TVM

The time value of money is relevant in various financial calculations, including:

- Net Present Value (NPV): Evaluating the profitability of an investment by comparing the present value of cash inflows and outflows.

- Internal Rate of Return (IRR): Determining the discount rate that makes the present value of future cash flows equal to the initial investment.

- Loan Amortization: Calculating the monthly payments on a loan, where each payment consists of both principal and interest.

- Valuation of Bonds and Stocks: Assessing the fair value of financial instruments based on future cash flows.

Conclusion

Understanding the relationship between the time value of money and interest rates is essential for various financial calculations, investment analysis, and decision-making processes. It helps individuals and businesses make informed choices about investments, loans, and the allocation of financial resources over time.