What is an Interest Rate Curve? What is a Yield Curve? What is the Term Structure of Interest Rates?

The above 3 questions above represent more or less the same question, asked in different financial jargon. Now that we know what bonds are and have learned about the US bond market, we are ready to answer it.

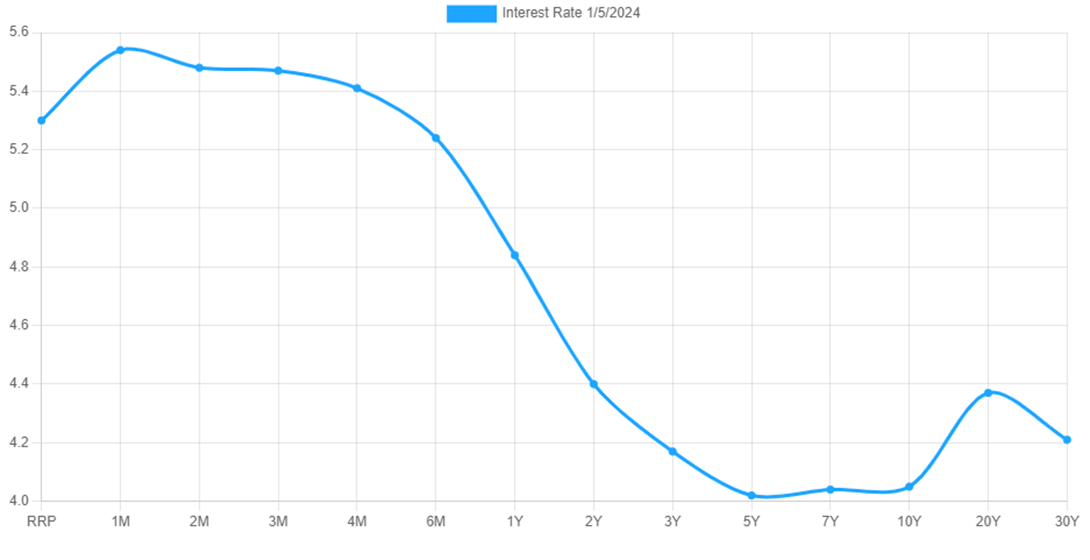

An interest rate curve, often referred to as a "yield curve," is a graphical representation of the relationship between interest rates (or yields) and the time to maturity of fixed-income securities. This graph is also called the term structure of interest rates

Here’s how the US Treasuries Yield Curve looks as of 5th Jan 2024:

Source: https://www.ustreasuryyieldcurve.com

Factors Influencing the Term Structure:

- Expectations of Future Interest Rates: The term structure is influenced by market expectations regarding the future direction of interest rates. If investors expect rates to rise, the yield curve may slope upward; if they expect rates to fall, it may slope downward.

- Risk and Uncertainty: Investors demand a premium for holding longer-term securities due to increased uncertainty and risk associated with a longer time horizon.

- Economic Conditions: Economic indicators, inflation expectations, and overall economic health can impact the shape of the yield curve.

Understanding the term structure of interest rates is essential for investors because it helps them make decisions about portfolio allocation, interest rate risk management, and economic forecasting. Policymakers, including central banks, also closely monitor the term structure to assess economic conditions and make informed decisions about monetary policy.