What is the Relationship Between a Bond’s Price and its Yield?

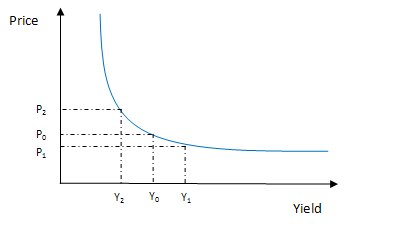

The relationship between the price and yield of a bond is inverse and is often referred to as the "price-yield relationship" or the "price-interest rate relationship." This relationship is fundamental to understanding how changes in interest rates impact the value of bonds in the secondary market.

Bond prices and yields move in opposite directions. When interest rates (yields) in the market rise, bond prices tend to fall, and vice versa. As interest rates rise, the market value of existing bonds falls because investors can obtain higher yields from newly issued bonds. Conversely, when interest rates decline, existing bonds may appreciate in value.