What Is the CBOE Volatility Index (VIX)?

The VIX, or the CBOE Volatility Index, is a popular measure of market expectations for future volatility. It is often referred to as the "fear gauge" because it tends to rise during periods of increased market uncertainty or fear and fall during more stable market conditions. The VIX is designed to reflect investors' perceptions of the expected volatility over the next 30 days in the U.S. stock market.

The VIX is calculated by the Chicago Board Options Exchange (CBOE) using the prices of options on the S&P 500 Index. It is derived from the implied volatility of a broad range of options with different strike prices and expiration dates.

A higher VIX value is generally associated with higher expected volatility and is often seen during market downturns or periods of increased uncertainty. Conversely, a lower VIX value suggests lower expected volatility and is often associated with more stable market conditions.

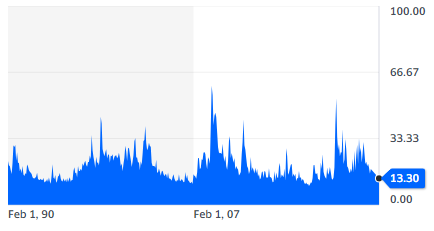

This is how VIX moved over the years: