Trading the Interest Rate Curve

As an interest rate curve (term structure) gets created, traders will be able to take a view of the curve shape. Yield curve dynamics represent a crucial macro variable because they inform us of today’s borrowing conditions and the market's future expectations for growth and inflation. Some examples:

An inverted yield curve often leads toward a recession because it chokes real-economy agents off with tight credit conditions (high front-end yields) which are reflected in weak future growth and inflation expectations (lower long-dated yields).

A steep yield curve instead signals accessible borrowing costs (low front-end yields) feeding into expectations for solid growth and inflation down the road (high long-dated yields).

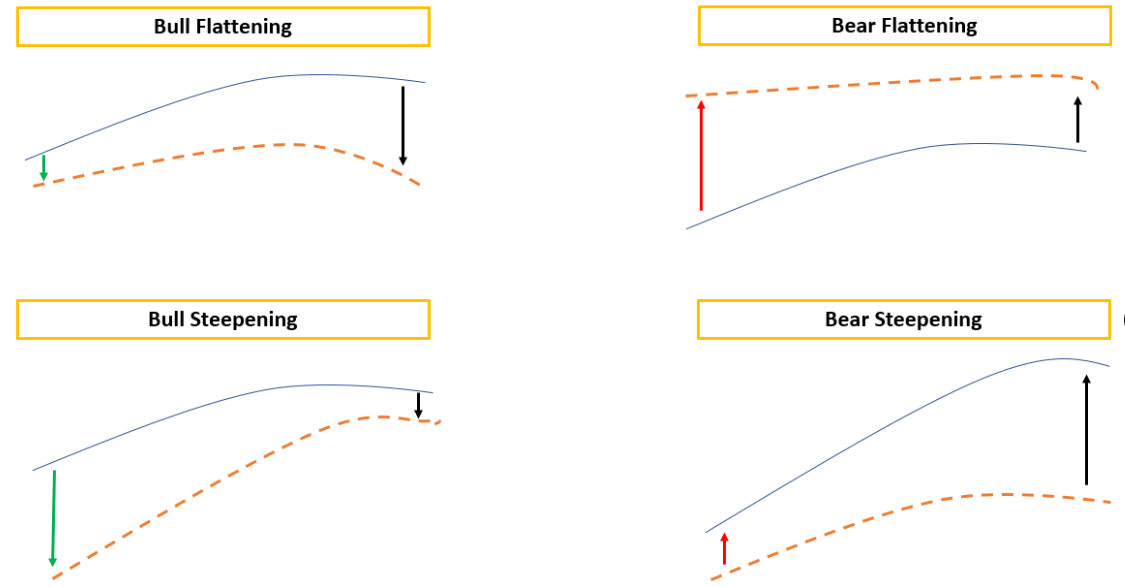

There are 4 main ways in which the interest rate curve can move:

1) Bull Flattening = lower front-end yields, flatter curves.

Think of 2016: Fed Funds are already close to 0% and global growth is weak. Yields stay put at the front end and could meaningfully move lower only at the long end, hence bull-flattening the curve.

2) Bull Steepening = lower front-end yields, steeper curves.

Late 2020, early 2021: the Fed was keeping rates pinned at 0% and stimulating the economy via QE (Quantitative Easing) but the economy was flooded with fiscal stimulus and ready for reopening. The friendly borrowing conditions and the massive upcoming growth boost could mostly be reflected through higher long-end yields, while 2-year interest rates were pinned at 0% by the Fed. This created a bull-steepening of the curve.

3) Bear Flattening = higher front-end yields, flatter curves.

2022 was the bear-flattening year: the Fed raised rates aggressively to fight inflation but ended up choking the economy off. This was reflected in lower future growth and inflation expectations at the long end of the curve. Front-end rates went higher, but the curve bear-flattened.

4) Bear Steepening = higher front-end yields, steeper curves.

Do you remember 2009? The worst of the GFC was behind us and investors were afraid that QE would lead to runaway inflation and the Fed would be forced to start acting on it. Front-end yields moved a bit higher, but long-end yields took most of the hit as investors (mistakenly) bumped the inflation risk premium up = the curve bear-steepened.