What is a Basis Trade?

A basis trade refers to a financial strategy in which an investor takes advantage of the price difference, or "basis," between two related financial instruments or markets. The goal of a basis trade is to profit from the perceived mispricing or divergence in prices between the two assets or markets.

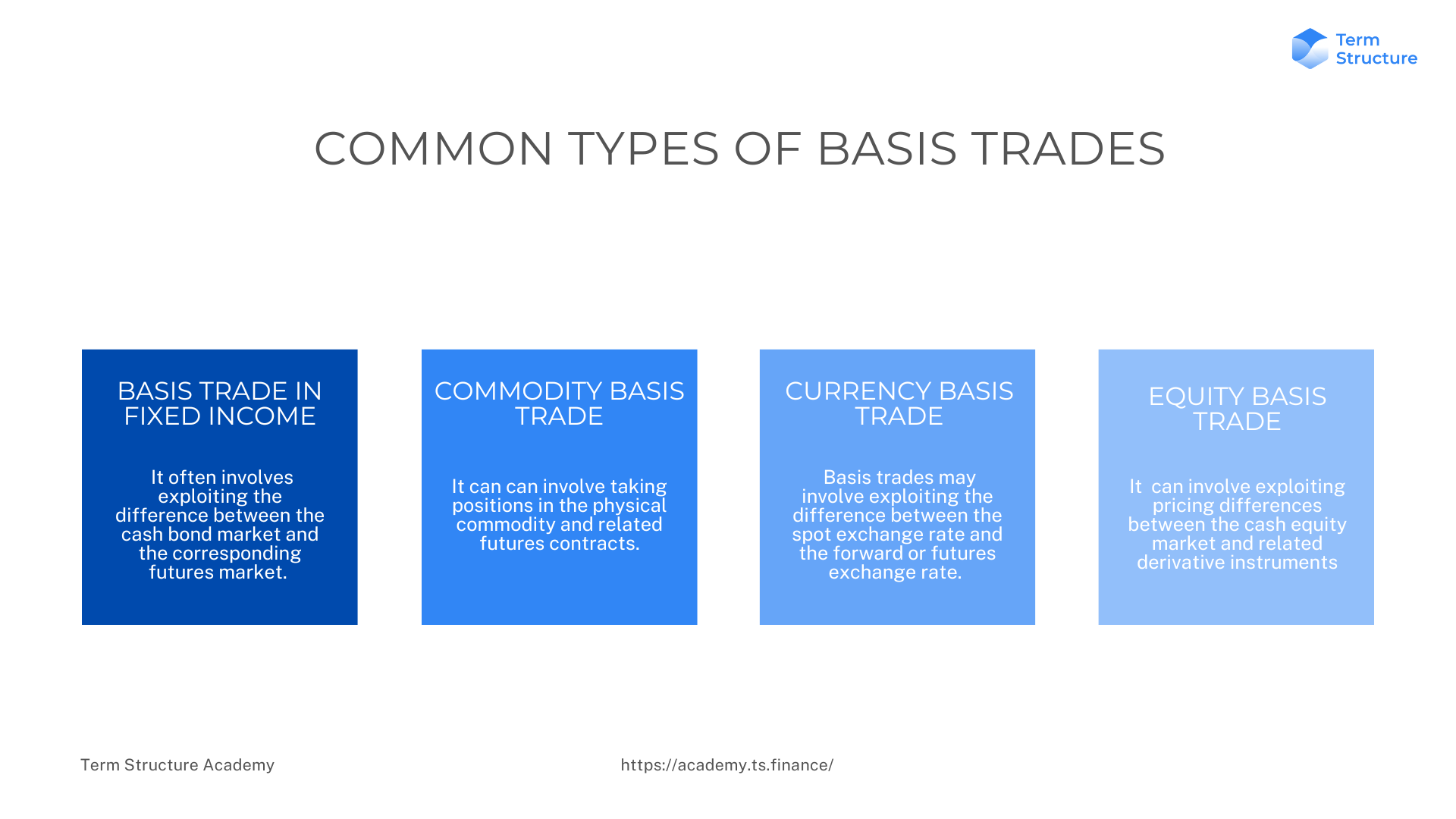

Here are a couple of common types of basis trades:

- Basis Trade in Fixed Income: In fixed income markets, a basis trade often involves exploiting the difference between the cash bond market and the corresponding futures market. The basis is the difference between the yield on a cash bond and the yield implied by the futures contract. Traders may take positions based on their expectations of how this basis will evolve over time.

- Commodity Basis Trade: In commodity markets, basis trading can involve taking positions in the physical commodity and related futures contracts. For example, an investor might buy a physical commodity (e.g., oil) while simultaneously selling futures contracts on that commodity. The basis, in this case, is the price difference between the spot market and the futures market.

- Currency Basis Trade: In currency markets, basis trades may involve exploiting the difference between the spot exchange rate and the forward or futures exchange rate. Traders could take positions to benefit from changes in the basis over time.

- Equity Basis Trade: In equity markets, basis trades can involve exploiting pricing differences between the cash equity market and related derivative instruments, such as equity futures or options.

Having read the above examples, we can quickly find an equivalent in Crypto Markets: trading the basis between Spot Bitcoin and a Bitcoin Future Contract.

Basis trades are often used by hedge funds, proprietary trading desks, and other institutional investors to generate returns while managing risk. Traders who engage in basis trading typically conduct thorough analyses of the factors affecting the pricing of the two related instruments and make informed predictions about how the basis will behave in the future.

It is important to note that basis trading involves risks, and the success of such strategies depends on the trader's ability to accurately assess the factors influencing the pricing relationship between the two assets or markets. Additionally, market conditions, liquidity, and other factors can impact the effectiveness of basis trades.