What is a Cross Currency Swap?

A Cross Currency Swap (CCS) is a financial derivative in which two parties exchange cash flows in different currencies over a specified period. The primary purpose of a cross-currency swap is to hedge or manage exposure to currency risk, allowing entities to obtain funding in one currency while making payments in another.

In a cross-currency swap, there are two main legs:

- Principal Exchange: At the initiation of the swap, the two parties exchange principal amounts in different currencies. The principal amounts are typically notional, meaning they are used for calculation purposes but are not physically exchanged.

- Interest Rate Payments: Throughout the life of the swap, the parties make periodic interest rate payments to each other based on the agreed-upon notional amounts and interest rates. The interest rates can be fixed or floating, depending on the terms of the swap.

Benefits of a Cross-Currency Swap

The structure of a cross-currency swap allows entities to achieve specific objectives:

- Currency Conversion: One party may use the cross-currency swap to convert a liability denominated in one currency into a liability in another currency. This is useful when a company has operations in multiple currencies and wants to match its liabilities with its revenue streams.

- Foreign Exchange Risk Management: Companies with exposure to foreign exchange risk can use cross-currency swaps to hedge against adverse movements in exchange rates. By locking in a fixed exchange rate, entities can mitigate the impact of currency fluctuations on their cash flows.

- Funding in Different Currencies: Entities may use cross-currency swaps to obtain funding in a currency that offers favorable interest rates while making payments in a different currency. This can be advantageous when one currency provides a cost advantage in terms of borrowing costs.

The Pricing Model

The pricing of a cross-currency swap involves calculating the present value of future cash flows in each currency, considering the exchange rate movements and interest rate differentials. The parties involved may agree on a fixed exchange rate for the principal exchange or allow for periodic adjustments.

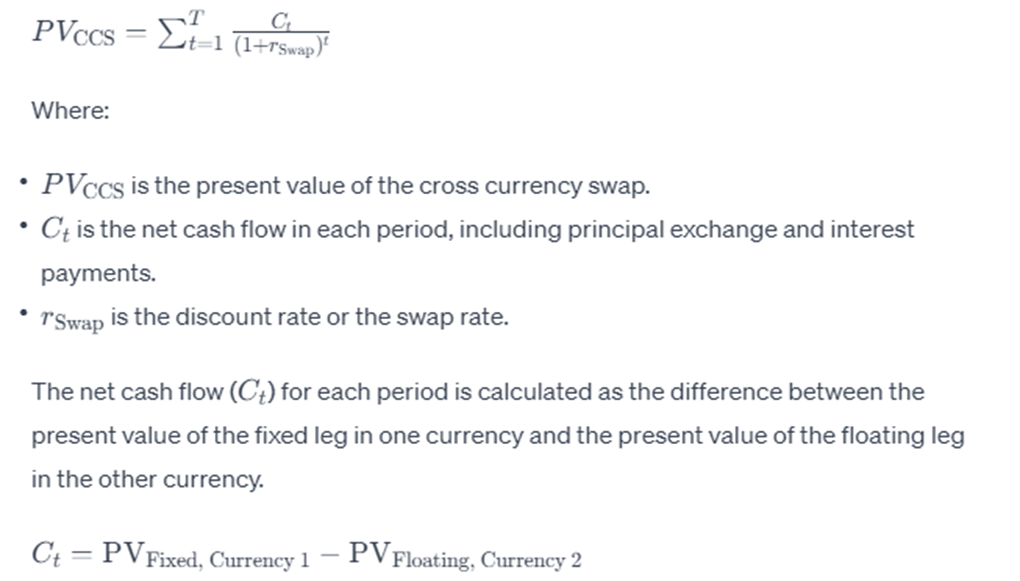

The general formula for the present value (PV) of a cross-currency swap is:

In practice, the calculation involves determining the present value of each future cash flow in both currencies, considering the relevant interest rates and exchange rates. This requires discounting each cash flow back to its present value using the appropriate discount factors.

We refer you to our article on interest rate swaps (IRS) to get a better understanding of the above formulas.

Conclusion

To conclude, cross-currency swaps are commonly used by multinational corporations, financial institutions, and sovereign entities to optimize their funding structure and manage currency risk efficiently. Like other financial derivatives, cross-currency swaps require careful consideration of the associated risks, including interest rate risk and exchange rate risk, and should align with the risk management objectives of the market participants involved.