What is a Foreign Exchange (FX) Swap?

A Foreign Exchange (FX) swap is a financial derivative transaction that involves the simultaneous purchase and sale of identical amounts of one currency for another but with two different value dates. FX swaps are commonly used by market participants, including banks, financial institutions, and corporations, to manage currency exposure and liquidity needs.

The FX swap transaction consists of two legs:

1. Spot Leg:

In the spot leg of the FX swap, the parties involved exchange the principal amounts of the two currencies at the prevailing spot exchange rate. The spot exchange rate is the rate at which currencies can be traded for immediate delivery (typically within two business days).

2. Forward Leg:

In the forward leg, the parties agree to reverse the initial exchange at a predetermined future date and a pre-agreed forward exchange rate. The forward exchange rate is the rate at which currencies will be exchanged at the agreed-upon future date.

The primary purpose of an FX swap is to allow participants to manage their currency exposure while maintaining liquidity.

Here's how an FX swap works in practice:

- Party A needs a certain amount of currency X and has currency Y.

- Party B needs currency Y and has currency X.

- In the spot leg, Party A exchanges currency Y for currency X with Party B at the current spot exchange rate.

- Simultaneously, in the forward leg, Party A agrees to sell currency X back to Party B at a predetermined forward exchange rate at a specified future date.

- At the agreed-upon future date, the parties exchange the currencies again, completing the FX swap.

The key features of an FX swap include:

- Interest Rate Differential: FX swaps may involve an interest rate differential between the two currencies, reflecting the cost of carrying the positions over the swap period.

- Maturity Dates: The maturity date of the forward leg is determined at the outset of the transaction and can vary depending on the needs of the parties involved.

- Net Cash Flow: In an FX swap, there is typically an initial exchange of currencies, but the net cash flow is settled at the maturity of the forward leg. The net cash flow is calculated based on the difference between the initial exchange rate and the forward exchange rate.

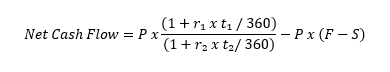

The formula for calculating the net cash flow or settlement amount in an FX swap depends on the interest rate differential between the two currencies involved in the swap. The net cash flow is determined at the maturity date of the swap and is based on the difference between the initial spot exchange rate and the agreed-upon forward exchange rate. The formula can be expressed as follows:

Where:

- P is the principal amount of the swap.

- r₁ is the interest rate of the currency being bought (in decimal form)

- r₂ is the interest rate of the currency being sold (in decimal form)

- t₁ is the number of days to the maturity date of the spot leg, typically expressed on a 360-day basis

- t₂ is the number of days to the maturity date of the forward leg, typically expressed on a 360-day basis

- F is the agreed-upon forward exchange rate

- S is the initial spot exchange rate

The calculation involves two components:

- The present value of the principal amount converted at the interest rate of the currency being bought.

- The difference between the present value of the principal and the forward contract's notional value, which represents the agreed-upon exchange rate.

To conclude, FX swaps are widely used for various purposes, including hedging currency risk, managing cash flows, and obtaining funding in different currencies. They provide flexibility to market participants in handling currency positions over different time frames while minimizing exposure to exchange rate fluctuations.