What is Covered / Uncovered Interest Rate Parity? How is it Related to Forwards?

Interest Rate Parity (IRP) is one of the most important theories in finance. It links the interest rates, exchange rates, and expected returns on foreign exchange investments among different currencies. It is based on the idea that, in an efficient market, returns on equivalent assets denominated in different currencies should be equal when expressed in a common currency. IRP plays a crucial role in the foreign exchange markets and helps explain how interest rates and currency values are interconnected.

There are two main forms of interest rate parity:

1. Covered Interest Rate Parity (CIRP):

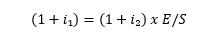

Covered Interest Rate Parity arises when there is a possibility to eliminate currency risk through the use of forward contracts. In a covered interest rate parity scenario, the interest rate differential between two countries is equal to the forward premium or discount on the foreign currency. The formula for Covered Interest Rate Parity is as follows:

Where:

- i₁ = Domestic interest rate

- i₂ = Foreign interest rate

- F = Forward exchange rate

- S = Spot exchange rate

The equation indicates that, in a covered interest rate parity situation, the interest rate differential should be offset by the forward exchange rate premium or discount.

2. Uncovered Interest Rate Parity (UIRP):

Uncovered Interest Rate Parity assumes that investors are not able to eliminate currency risk through the use of forward contracts. Instead, it focuses on the relationship between spot exchange rates, interest rates, and expected future spot rates. The formula for Uncovered Interest Rate Parity is as follows:

Where:

- i₁ = Domestic interest rate

- i₂ = Foreign interest rate

- E = Expected future spot exchange rate

- S = Spot exchange rate

The equation implies that, in an uncovered interest rate parity situation, the interest rate differential is equal to the expected percentage change in the exchange rate.

Conclusion

Interest Rate Parity is a fundamental concept in international finance and is essential for understanding the relationships between interest rates and exchange rates.

In particular, Covered Interest Rate Parity establishes a relationship between interest rates, spot exchange rates, and forward exchange rates, and it plays a crucial role in determining the pricing of forward contracts.

Interest Rate Parity allows us to build forward markets and term futures, important products for transferring and hedging risk.